How Does Investing Work? Start Simple with Index Funds

If you're curious about building wealth but don't know where to begin, investing gives you a way to put your money to work. You don't need an economics degree—just a smart approach and some basic knowledge. A practical place to start is with index funds, which let you grow your savings while spreading out risk. But before you jump in, you should understand what makes this method both accessible and effective, and what you’ll need to watch for next.

Understanding the Concept of Investment

Investment involves allocating resources, such as time or capital, into various assets with the expectation of value appreciation over time. Common asset classes include stocks, bonds, and real estate. By establishing an account with a brokerage firm or banking institution, one gains access to different investment vehicles, such as mutual funds and exchange-traded funds (ETFs).

Consulting with a financial advisor can provide valuable insights into assessing individual investment goals, risk tolerance, and tax implications.

It is important to recognize that investments carry inherent market risks; therefore, there is no assurance of consistent returns. Various factors, including changing interest rates, the performance of underlying assets, and associated fees, can significantly influence the overall rate of return on an investment portfolio.

Market conditions can lead to fluctuations in value, where an investment may either appreciate or depreciate. Consequently, careful analysis and informed decision-making are essential components of a successful investment strategy.

Types of Assets You Can Invest In

A well-structured investment portfolio typically includes a variety of asset types, each with unique advantages and associated risks. Common investment options include stocks, bonds, real estate, mutual funds, exchange-traded funds (ETFs), and cryptocurrencies.

Stocks represent ownership in a company and have the potential for capital appreciation; however, they are also subject to market fluctuations, which can lead to significant risks. Bonds, along with certificates of deposit and money market accounts, generally provide lower yields compared to stocks, but they also present a reduced likelihood of principal loss, making them a more conservative choice for risk-averse investors.

Real estate investments can yield higher returns in the long term, though they often entail additional factors such as varying tax implications and management fees that investors should carefully evaluate.

Mutual funds offer diversification and professional management but may charge management fees that can impact overall returns.

Exchange-traded funds (ETFs) combine aspects of mutual funds and stocks, allowing for easy trading and diversification while often having lower expense ratios. Cryptocurrencies, while gaining popularity, are highly volatile and speculative, which requires a careful analysis of risk before investment.

When considering these various asset types, it is essential to assess your risk tolerance and account options. Consulting with financial professionals or advisors can provide valuable guidance tailored to individual investment goals.

Why Consider Index Funds as a Starting Point

Index funds present a viable option for individuals who are new to investing due to their straightforward structure and inherent diversification benefits. An index fund can either be a mutual fund or an exchange-traded fund (ETF), enabling investors to allocate their capital across a wide range of assets within a single investment vehicle. This diversification helps mitigate the risks associated with individual securities and can provide more stable returns over time.

In contrast to higher-risk investments, index funds are typically designed to endure market fluctuations, making them a less volatile choice for investors. They generally exhibit a long-term upward trend in value, although it is important to note that past performance is not indicative of future results.

One of the additional advantages of index funds is their cost-effectiveness, often featuring lower management fees compared to actively managed funds.

Although investing always carries risks, many financial professionals advocate for index funds as a foundation for a diversified investment portfolio. They align well with common investment objectives, encouraging a passive investment strategy that can suit a wide range of individual goals.

Nevertheless, investors should consider their own financial situation and investment objectives before committing to any specific investment strategy.

Steps to Begin Your Investment Journey

Individuals considering the initiation of an investment journey should approach the process with a structured strategy. Start by clearly defining your financial objectives, which may include retirement planning, estate management, or setting up an emergency fund. Such clarity will inform your investment decisions.

Subsequently, establish a brokerage account or a trust, which will provide access to various investment vehicles such as exchange-traded funds (ETFs) and mutual funds. It is prudent to evaluate the associated fees, banking products, and routing information to ensure that you select a service that aligns with your financial goals.

Next, conduct thorough research on different types of investments. This includes understanding how various assets, such as money market funds, certificates of deposit (CDs), and loans, can contribute to a balanced portfolio.

Awareness of key concepts such as the rate of return, market volatility, and tax implications is essential for making informed choices.

Finally, it is advisable to regularly review your investment portfolio with the assistance of a financial advisor or other professionals. This practice can help to monitor the growth and performance of your investments, ensuring alignment with your evolving financial objectives over time.

Assessing and Managing Risk in Your Portfolio

Diversification is a fundamental strategy for managing risk within an investment portfolio. By allocating your investments across a range of asset classes—such as stocks, bonds, real estate, and mutual funds—you can mitigate the potential impact of underperformance in any single asset category. This approach helps to spread risk, enhancing overall portfolio stability.

It is essential to assess your risk tolerance when determining your investment mix. This assessment should take into account your financial goals, the potential impact of interest rate fluctuations, and the nature of market volatility.

It is important to recognize that even well-regarded investments, including exchange-traded funds (ETFs), mutual funds, money market instruments, and certificates of deposit, are exposed to market risks. They cannot guarantee future returns, nor can one expect consistent value appreciation.

For a comprehensive understanding of your investment choices, it is advisable to consult with a financial advisor or trust service representative. They can provide vital information regarding associated fees, tax implications, and strategies for maintaining an emergency fund, which can greatly enhance your financial resilience.

Calculating and Comparing Returns on Investments

Evaluating the effectiveness

Key Factors to Consider Before Investing

Before investing in the market, it is essential to clarify your financial objectives and assess your comfort level with risk. Clearly defining your goals—whether they involve building an estate, establishing an emergency fund, or seeking higher returns—will guide your investment decisions.

Additionally, evaluating your risk tolerance is critical in selecting suitable investment vehicles, which may include mutual funds, index funds, Certificates of Deposit (CDs), or Money Market accounts.

It is important to acknowledge that all investments are subject to market fluctuations, and there is potential for loss of value over time. A comprehensive analysis of different brokerage firms is advisable, taking into consideration factors such as fees, interest rates, tax implications, and the range of services offered.

While aiming for returns, one should remain cognizant that no investment guarantees future performance. Thus, thorough research and diligent consideration of these variables are necessary steps before committing capital to the market.

The Role of Professional Guidance in Investing

Engaging with a financial professional can enhance the investment process and refine decision-making capabilities. A key benefit of this collaboration is the clarification of individual financial goals and risk tolerance, which serves as the foundation for informed investment choices.

Financial professionals can explain various investment vehicles, including exchange-traded funds (ETFs), mutual funds, and Certificates of Deposit (CDs), and help assess the associated fee structures for each option.

Furthermore, an advisor can assist in selecting appropriate accounts or brokerage platforms, allowing investors to effectively navigate market fluctuations, liquidity challenges in money markets, and the implications of taxation on their returns.

It is important to recognize that investing inherently involves risk; market conditions can impact rates of return, and assets can depreciate in value over time.

Nevertheless, professional financial services can be instrumental in optimizing investment performance over the long term. By advising on risk management and diversifying portfolios, advisors can help mitigate the likelihood of high-risk investments, thereby supporting the overall growth of an investment portfolio while also addressing the need for liquidity in emergency funds.

Building and Monitoring an Investment Portfolio

Constructing a balanced investment portfolio involves a strategic selection of various asset classes, including stocks, bonds, and index funds. This approach aims to spread risk while supporting potential long-term growth.

When building your portfolio, it is essential to evaluate factors such as your risk tolerance, investment objectives, and the type of accounts involved, whether they are personal or trust accounts.

Diversification is a key strategy that may mitigate market volatility and limit the likelihood of significant losses. Incorporating mutual funds, exchange-traded funds (ETFs), and Certificates of Deposit (CDs) can enhance this diversification. These financial instruments offer different levels of risk and return, which can be aligned with your overall investment strategy.

It is prudent to regularly review your portfolio, ideally in consultation with a financial advisor or brokerage. This review should include an assessment of fees, interest rates, and tax implications affecting your investments.

Financial professionals are equipped to provide insights into effective strategies that align with dynamic market conditions and individual circumstances, such as the need for an emergency fund. By staying informed and proactive, you can better navigate the complexities of investment management while remaining aligned with your financial goals.

Conclusion

Investing doesn’t have to be complicated. By starting with index funds, you’re choosing a simple, cost-effective way to build your portfolio and benefit from diversification. Remember to take time to research, set clear goals, and understand the risks involved. Regularly review your investments and don’t hesitate to seek professional guidance if you need it. With a steady, thoughtful approach, you’ll be well-positioned to work toward your long-term financial goals.

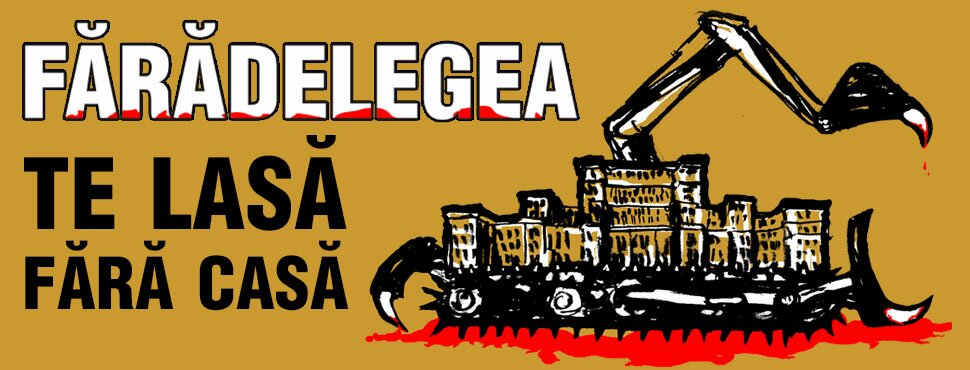

Pentru mai multe informații despre campania vă rugăm să vizitați

Pentru mai multe informații despre campania vă rugăm să vizitați