Credit Consolidation Loans: Strategy, Risks, and Alternatives

If you're struggling to keep up with multiple debts, credit consolidation loans can look like a practical way to regain control, simplify your payments, and even ease your financial stress. But before you commit, it's smart to consider how consolidation works, what pitfalls it might bring, and what other options you could have. What you choose now could shape your financial stability for years—so what's really the best move?

Understanding Debt Consolidation Loans

Debt consolidation loans serve as a strategic approach for individuals managing multiple debts by combining various balances into one manageable payment. Typically, this process involves securing a personal loan, often at a competitive interest rate that is influenced by the borrower’s credit score and overall eligibility.

When considering a debt consolidation loan, it is essential to evaluate the terms and conditions associated with the loan, including interest rates, monthly payments, and any potential fees. While consolidating debts can lead to a lower annual percentage rate (APR) compared to existing credit card rates, it is important to note that this method does not eliminate the underlying debt.

Effective management of the consolidation loan requires diligent tracking of payment history and adherence to responsible financial practices.

Additionally, understanding the implications of payment history on credit scores is crucial, as it can significantly impact future borrowing options.

Therefore, a thorough analysis of one's financial situation and repayment strategy is advisable before proceeding with a debt consolidation loan.

Main Advantages of Consolidating Debt

Managing multiple debts can be complex and challenging. Consolidating these debts into a single loan can simplify the repayment process and potentially lower overall interest expenses. By consolidating debts, individuals can reduce the number of monthly payments they need to manage, which can enhance budgeting and decrease the likelihood of missed payments.

Often, debt consolidation offers a lower interest rate or annual percentage rate (APR) compared to existing credit card debts or personal loans. This reduction in interest can translate to significant savings over time. Additionally, as repayments are made consistently, borrowers may observe a decrease in their credit utilization ratio and an improvement in their payment history. Both factors can positively influence credit scores.

Furthermore, debt consolidation enables individuals to regain control over their finances. It can help bring past-due accounts up to date and may provide clarity on overall financial standing, allowing for more informed decision-making regarding future financial strategies.

However, it is important for individuals to carefully assess whether debt consolidation aligns with their long-term financial goals and to consider potential risks, such as accumulating more debt if spending habits do not change.

Potential Drawbacks to Consider

While consolidating debt can present numerous advantages, it is essential to consider potential drawbacks before proceeding. One significant factor to evaluate is the associated costs; obtaining a new loan often comes with fees and origination charges that can impact the overall financial benefit.

Additionally, individuals with lower credit scores or limited eligibility may face higher annual percentage rates (APR) than their existing loans, leading to an increase in total interest payments over time.

It is also crucial to recognize that missed payments on the new consolidated loan can adversely affect one's payment history, which is a key component of credit scores.

Furthermore, some lenders may conduct a hard inquiry into your credit report when you apply for a new loan, which could temporarily lower your credit score.

Lastly, if borrowers continue to utilize credit cards after consolidation without proper budgeting, they risk accumulating more debt, potentially undermining the goals of the debt consolidation process.

It is therefore advisable to undertake thorough planning and evaluation before committing to debt consolidation.

Impact of Debt Consolidation on Credit Scores

Before considering a credit consolidation loan, it is essential to evaluate its potential impact on your credit score, both in the short term and long term. Securing a new loan or a balance transfer card typically results in a hard inquiry on your credit report, which may cause a temporary decline in your score.

However, effective debt consolidation can help lower your credit utilization ratio, a factor that generally supports credit score improvement.

It is important to note that several factors may negatively influence your credit score during this process. For instance, missed payments on the new loan can adversely affect your payment history, which is a significant component of credit scoring.

Additionally, closing old accounts after consolidation may reduce your average account age, further impacting your score negatively.

To manage the potential effects on your credit score, it is advisable to monitor your credit regularly, comprehend the terms and conditions of any consolidation loan, and utilize any available alerts for payments or changes in credit status.

Evaluating these factors will assist you in determining whether debt consolidation aligns with your overall financial strategy.

Assessing Your Readiness for Debt Consolidation

Determining whether debt consolidation is a suitable financial strategy requires a thorough evaluation of several factors.

Begin by objectively assessing your current debts alongside your monthly income. Consider if you can reliably manage a single, consolidated payment rather than multiple ones. It is also essential to review your credit score and payment history, as these elements significantly influence your eligibility for lower interest rates or more favorable loan terms.

When exploring debt consolidation options, ensure you fully understand the annual percentage rate (APR), associated fees, and loan terms offered by financial institutions or balance transfer credit cards. A cost-benefit analysis is advisable; calculate if consolidating your debts into one monthly payment results in overall savings after accounting for any potential fees.

Additionally, reflect on your money management skills and level of commitment to maintaining consistent payments.

Be aware of the risks involved, such as identity theft or fraud, which can arise during the consolidation process. A candid evaluation of these factors will better inform your decision on whether debt consolidation is an appropriate solution for your financial situation.

Choosing the Right Consolidation Method

Choosing the appropriate method for debt consolidation requires careful consideration of your specific financial situation and objectives. When dealing with multiple debts, opting for a consolidation loan may provide the advantage of a single monthly payment along with potentially lower interest rates or annual percentage rates (APRs) compared to your existing debts.

Alternatively, a balance transfer credit card might be advantageous if you possess a favorable credit profile and can benefit from introductory or promotional interest rates.

It is crucial to thoroughly assess associated fees, eligibility criteria, and the terms and conditions outlined by financial institutions offering these products. Pre-qualifying for loans or credit cards typically does not result in a hard inquiry on your credit report, which can be a beneficial step in evaluating your options without impacting your credit score.

Moreover, it is advisable to maintain meticulous records of your application statuses to ensure timely submissions and avoid missing payment deadlines. Neglecting these details can lead to adverse effects on your credit standing and overall financial health.

By adopting a systematic approach, individuals can make informed decisions regarding their debt consolidation strategies.

Steps to Consolidate Your Debt

A thorough assessment of your existing financial obligations is essential for developing an effective debt consolidation strategy. Begin by compiling a comprehensive list of all debts, which should include account balances, interest rates, monthly payments, and repayment terms. This information will serve as a foundation for evaluating consolidation options.

Next, investigate various lending sources such as home equity lines of credit, banks, or online lenders. Pay particular attention to interest rates, annual percentage rates (APR), and associated fees, as these factors can significantly impact the overall cost of the consolidation loan.

Additionally, reviewing your credit report is crucial. This allows you to check for inaccuracies, monitor for potential fraud, and understand your eligibility for different loan products. Be cognizant of how hard inquiries can affect your credit score when shopping for loans.

Assemble necessary documentation, including your Social Security number, proof of income, and recent credit card statements, to facilitate a smoother application process. Upon approval of the consolidation loan, utilize the funds to pay off multiple debts, thereby simplifying your payment schedule to a single monthly obligation.

Finally, it is important to remain diligent in tracking your payment schedule to prevent missed payments, which can lead to financial complications and potentially harm your credit rating. Moreover, safeguarding your personal information is critical to protect against identity theft.

By approaching debt consolidation with careful planning and informed decision-making, you can work toward more manageable financial obligations.

Exploring Alternatives to Debt Consolidation

Not every route to achieving financial stability necessitates acquiring a new loan or utilizing a consolidation product.

One viable option is to engage a nonprofit credit counselor to establish a debt management plan. This approach can facilitate negotiations for lower interest rates and consolidate payments into a single monthly installment, all without the need for additional loans or the risk associated with hard inquiries on your credit report.

Alternatively, a balance transfer credit card may be utilized, particularly those offering a promotional period with a lower annual percentage rate (APR). While this can lead to reduced interest payments, potential applicants should be mindful of eligibility requirements and any associated fees.

Exploring personal loans through credit unions or alternative lenders can also be advantageous, as they may provide interest rates that are more favorable than those of your existing credit accounts.

It is crucial to remain vigilant against identity theft and fraud. Regular monitoring of your credit report, keeping track of payment history, and setting up alerts for credit utilization can serve as effective strategies to safeguard your financial information.

Conclusion

Before choosing a credit consolidation loan, take time to weigh the pros and cons in light of your unique financial situation. Don’t rush—research thoroughly, consider alternatives, and reach out for professional advice if you’re unsure. Regularly monitor your credit, stick to a clear repayment plan, and avoid taking on new debt. With careful planning and commitment, you’ll improve your financial health and set yourself on a path toward long-term stability.

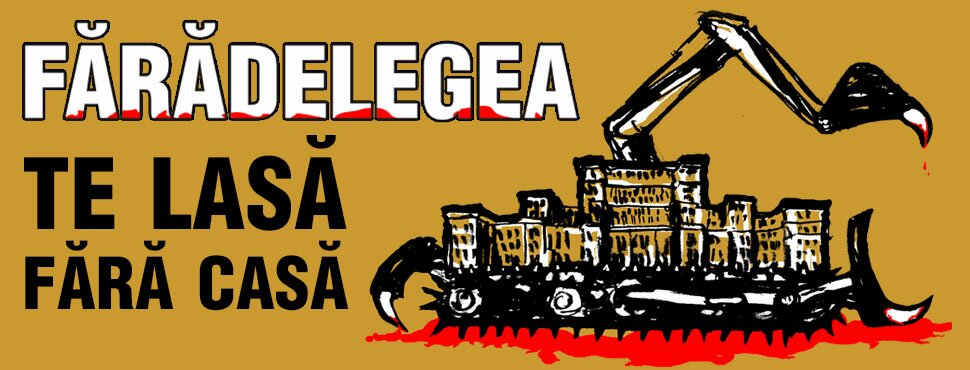

Pentru mai multe informații despre campania vă rugăm să vizitați

Pentru mai multe informații despre campania vă rugăm să vizitați