Business Credit Loans: Building Profiles and Securing Limits

When you’re looking to grow your business, access to credit can make all the difference, but getting approved for the right loan isn’t as simple as it seems. You’ll need more than just a good idea—building a solid credit profile and understanding what lenders really look for are crucial steps. Before you can confidently approach lenders and secure favorable terms, there are essential moves you shouldn’t overlook.

Understanding the Fundamentals of Business Credit

Business credit and personal credit, although they may exhibit some similarities, fulfill different functions within the financial landscape. A business credit score is calculated using data distinct from an individual's personal Social Security number. Establishing a legal business entity and obtaining an Employer Identification Number (EIN) is essential, as this number serves to identify the business in a manner analogous to a Social Security number for individuals.

To build a strong business credit profile, it is advisable to engage with vendors and suppliers that extend credit terms and report payment history to major credit bureaus, specifically Dun & Bradstreet, Experian, and Equifax.

Maintaining a good payment history, minimizing debt levels, adhering to payment terms, and conducting regular reviews of credit reports play crucial roles in strengthening a business credit score.

A robust business credit score can facilitate access to favorable financing terms, support business expansion, and result in lower interest rates, thereby contributing positively to the overall financial health of the organization.

Ensuring that a business credit score is well-managed is therefore an important aspect of strategic business planning.

Key Steps to Establishing a Strong Business Credit Profile

To establish a solid business credit profile, it is essential to implement specific steps that distinctly segregate your business's financial operations from personal finances. The first step is to register your business as a legal entity, which provides a formal legal distinction between personal and business liabilities. Following this, it is crucial to obtain an Employer Identification Number (EIN), which functions similarly to a Social Security number for businesses.

Next, open a dedicated business bank account. This account should be exclusively for business transactions to maintain accurate financial records.

It is also advisable to establish accounts with vendors and suppliers that report to credit bureaus. For instance, Dun & Bradstreet assigns a unique number, known as a D-U-N-S Number, which is vital for tracking your business’s creditworthiness.

Engaging with vendors that offer payment terms can be beneficial, provided that payments are made punctually. Timely payments contribute positively to your credit history.

Additionally, it is prudent to maintain low debt levels, as this can enhance your standing with potential lenders.

By adhering to these practices, businesses can improve their credit profile, which can lead to better funding options, more favorable interest rates, and potential growth opportunities.

Managing Vendor and Lender Relationships Effectively

Establishing and maintaining effective relationships with vendors and lenders is essential for the development and sustainability of a company's business credit. Engaging with vendors and suppliers that report payment activity to major credit bureaus, such as Dun & Bradstreet, can be instrumental in enhancing your business credit score, particularly when payments are made in a timely manner.

Consistently paying bills on or before their due dates can facilitate negotiations for more favorable payment terms and potentially lower interest rates on small business loans or SBA financing options.

Furthermore, prudent cash flow management is crucial in avoiding late payments, which can negatively impact credit standings. It is equally important to ensure that your company's legal address and contact information are accurate and current, as discrepancies can hinder communication and transaction processes.

The cultivation of trade references and the maintenance of a good payment history are key factors that can influence future funding opportunities and secure improved terms for commercial real estate financing or accounts receivable loans.

A structured approach to vendor and lender relationships not only supports current operational needs but also lays the groundwork for future financial growth and stability.

Monitoring and Enhancing Your Business Credit Scores

Regular monitoring of your business credit scores is crucial for identifying potential issues before they progress, thereby protecting your company’s standing with lenders and suppliers. It is advisable to review credit reports from major bureaus, including Dun & Bradstreet, Experian, and Equifax, on a consistent basis.

Additionally, implementing alerts for any changes in your credit profile—such as the opening of new accounts or updates to trade lines—can help maintain oversight.

To foster a positive credit score, it is important to pay bills punctually, manage debt levels judiciously, and keep the credit utilization ratio below 30%. Consistent and timely payments, along with a variety of credit accounts that report to the bureaus, contribute to building a solid credit profile.

This can lead to improved interest rates and more favorable terms when negotiating with vendors, suppliers, or when seeking financing options such as SBA loans, receivables financing, commercial real estate loans, or term loans.

In summary, proactive management of business credit is essential for sustaining financial health and ensuring access to credit when needed.

Common Challenges and Resources for Building Business Credit

Building robust business credit requires navigating several prevalent challenges that may hinder progress. Key issues such as late payments, inconsistent business information, and an excessive reliance on personal credit—specifically utilizing a Social Security number rather than an Employer Identification Number—can adversely affect your business credit score.

To mitigate these risks, it is advisable to open accounts with lenders and vendors that regularly report to credit bureaus, including Dun & Bradstreet. Additionally, ensuring timely payment of bills is critical, as it directly influences credit standing.

Maintaining a stable cash flow is also essential, as it provides a solid foundation for fulfilling financial obligations. Engaging with vendors and suppliers that offer favorable payment terms can further enhance your credit profile.

As your business credit score improves, it may be beneficial to negotiate better terms to optimize financial management. Furthermore, educational resources and informative articles can guide business owners in making informed decisions regarding the establishment and maintenance of business credit, ultimately supporting consistent financial growth.

Conclusion

Securing business credit loans requires more than just meeting minimum qualifications—you need to actively manage your profile and relationships. By establishing your business legally, maintaining accurate records, and monitoring your credit score, you'll put your company in a strong position for growth. Avoid common mistakes, know your financial limits, and always compare loan options. These steps will help you access better terms and larger limits, allowing your business to succeed and expand in today’s competitive market.

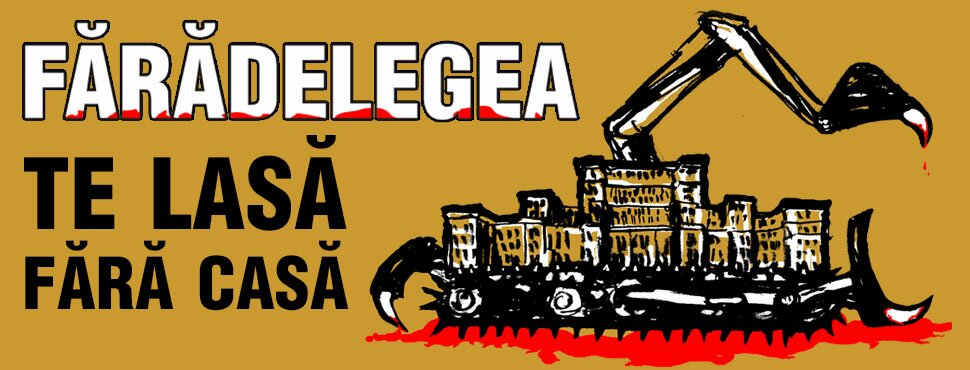

Pentru mai multe informații despre campania vă rugăm să vizitați

Pentru mai multe informații despre campania vă rugăm să vizitați